The global financial landscape of 2024 is characterized by unprecedented volatility, driven by geopolitical tensions and fluctuating domestic policies. This turbulent environment has posed significant challenges to traditional fixed income strategies, which now grapple with low yields, reduced diversification benefits, and increased duration risk. As a result, investors are increasingly turning to alternative avenues for returns, with private credit emerging as a compelling option.

Within the realm of private credit, direct lending to hedge funds has gained particular attention. This strategy offers several advantages, including higher yield potential through illiquidity and complexity premiums, improved diversification with low correlation to traditional assets, and more flexible risk management through customized covenants and active monitoring. A particularly promising segment within this space is first loss investing and hedge fund incubation strategies, which offer the potential for enhanced returns and access to rising talent in the industry.

However, these strategies are not without risks. Investors must carefully consider illiquidity risk, potential systemic disruptions, regulatory changes, and operational complexities. Implementing hedge fund lending in a portfolio requires careful consideration, typically as a satellite allocation within a broader fixed income or alternatives portfolio. Crucial factors include manager selection, diversification across strategies and geographies, liquidity management, and rigorous risk monitoring.

The interconnectedness of global markets was starkly illustrated on July 31, 2024, when the Bank of Japan unexpectedly hiked its interest rate to 0.25%. This move caused significant market disruptions, leading to the unwinding of the yen carry trade, a 20% crash in Japanese stocks, and a 5% depreciation of the dollar against the yen. The BOJ’s outsized influence, due to its large balance sheet, amplified the global impact of this decision.

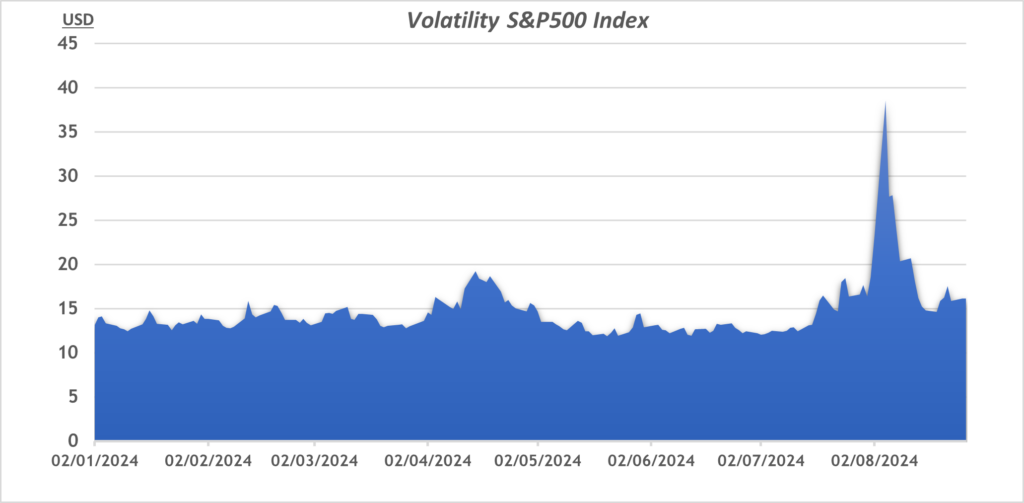

The week following the BOJ’s announcement was particularly dramatic. On August 5th, the S&P 500 initially plunged over 4% but managed to end the week with only a minimal 0.04% loss. The Volatility Index (VIX) experienced unprecedented swings, reaching a high of 65.73 before closing at 38.57 on Monday, marking the largest peak-to-close decline ever. Over the next four trading days, the VIX fell 47%, its largest four-day decline on record, ending the week at 20.37. This rapid reversal highlights the powerful mean reversion tendency in market volatility (see Chart 1).

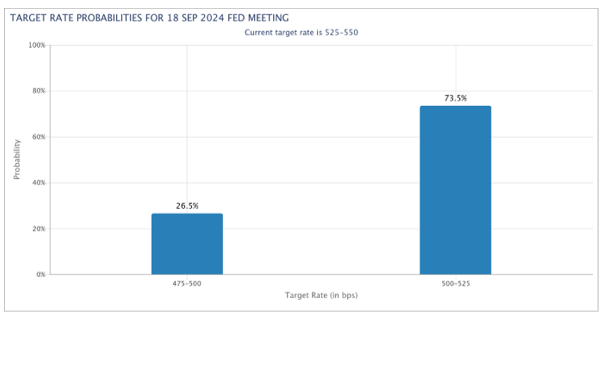

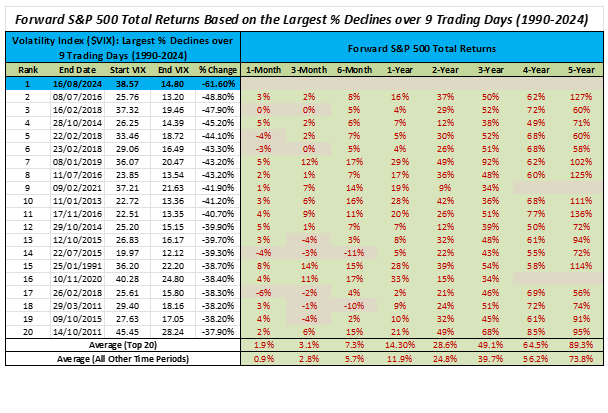

Looking ahead, markets are anticipating a US rate cut. Most seem to think the cut will be 25pbs (Chart 2) although this has not always been a good indicator. If the U.S. Federal Reserve cuts rates in September and November 2024, it could further strengthen the Japanese Yen and potentially lead to a more extensive unwinding of the Yen carry trade. This scenario might result in volatile risk assets crashing in the near term. However, from a longer-term perspective, historical patterns suggest reason for optimism. Since 1990, rapid VIX contractions similar to the one observed in August 2024 have typically preceded an average 14% gain in the S&P 500 index over the subsequent 12 months (see Chart 3).

For investors navigating this complex landscape, several key considerations emerge. It’s crucial to prepare for near-term volatility, especially in markets sensitive to carry trades. While safe-haven assets may be attractive in the short term, the potential for a continuing bull market trend should not be overlooked in longer-term strategic positioning. Close monitoring of central bank actions, particularly those of the Federal Reserve and Bank of Japan, will be essential, as will attention to dynamics in emerging markets, which often serve as important targets for carry trades.

In conclusion, while the current market environment presents significant challenges, it also offers opportunities for those able to navigate its complexities. Hedge fund lending strategies, in particular, may serve as a powerful tool for achieving excess returns and optimizing credit market exposures. However, successful implementation requires careful consideration, thorough due diligence, and professional management. As always in financial markets, the key lies in balancing short-term fluctuations with long-term trends, and in understanding the intricate interconnections that drive global market dynamics.

Paravene Capital is a multi-strategy Investment Manager, that marries proven systematic trading strategies with downside protection structures to deliver uncorrelated, stable return streams.

Sources

1 TradingView

2 Fed CME Watchtool

3 Bloomberg